By MANIK MEHTA/American Journal of Transportation

Article published September 11, 2017

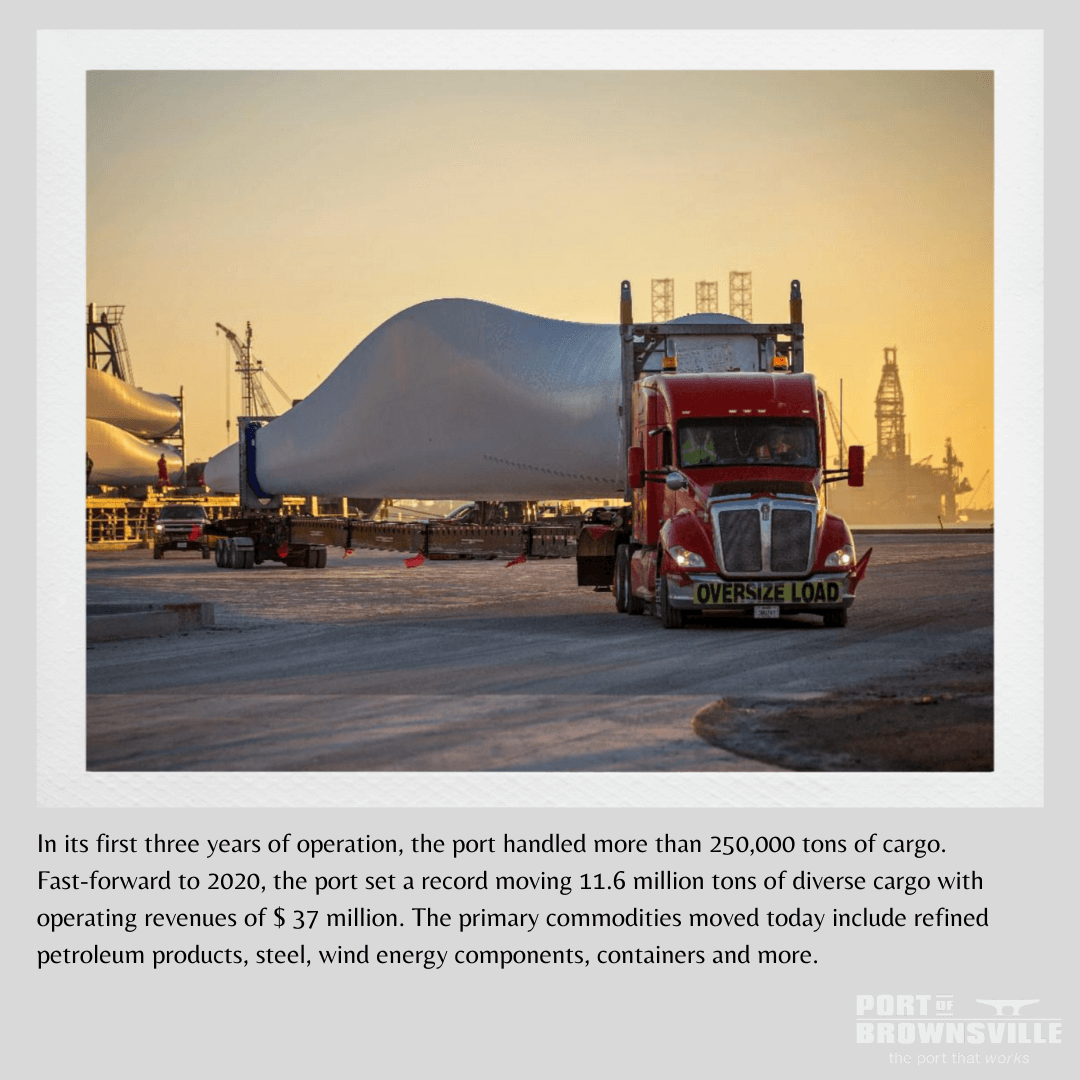

Port of Brownsville, located on the U.S.-Mexican border, is embarking on a $250 million infrastructure project that will deepen the port’s channel to 52 feet. The added depth is needed to keep Brownsville competitive and growing.

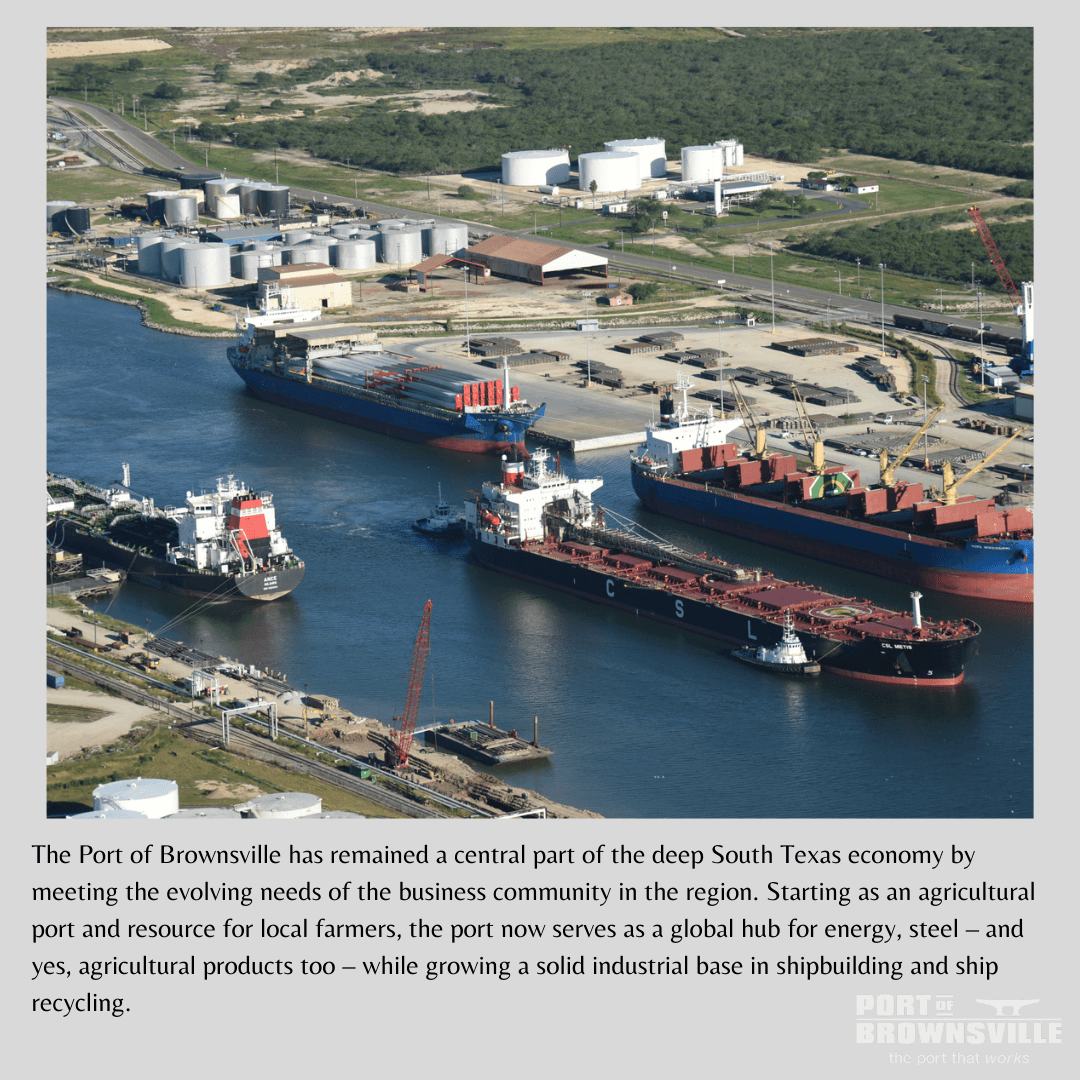

The Port of Brownsville in Brownsville, Texas, perched on the U.S.-Mexican borders, has deep interest in the flourishing trade between the United States and Mexico, and beyond in Central America, with the port having evolved to become a major trade channel between Texas and Mexico.

In order to further strengthen its position, the Port of Brownsville has embarked on major infrastructure development. The port is planning to increase its depth from 42 to 52 feet following the U.S. Congress’ approval in 2016.

“After years of planning, the U.S. Congress authorized the deepening of the 17-mile-long Port of Brownsville shipping channel from 42 feet to 52 feet, ranking it among the deepest channels on the Gulf of Mexico upon completion. The deepening project is expected to top $250 million,” Steve Tyndal, senior director (marketing and business development) of Port of Brownsville, observed in an interview with the AJOT, at the recent Steel Survival Strategies (SSS-XXXII) conference in New York.

Oil rig and ship building are integral and critical legacy industries at the port, requiring deeper water to grow. For future sustainability, it is necessary to deepen the port’s shipping channel to remain competitive.

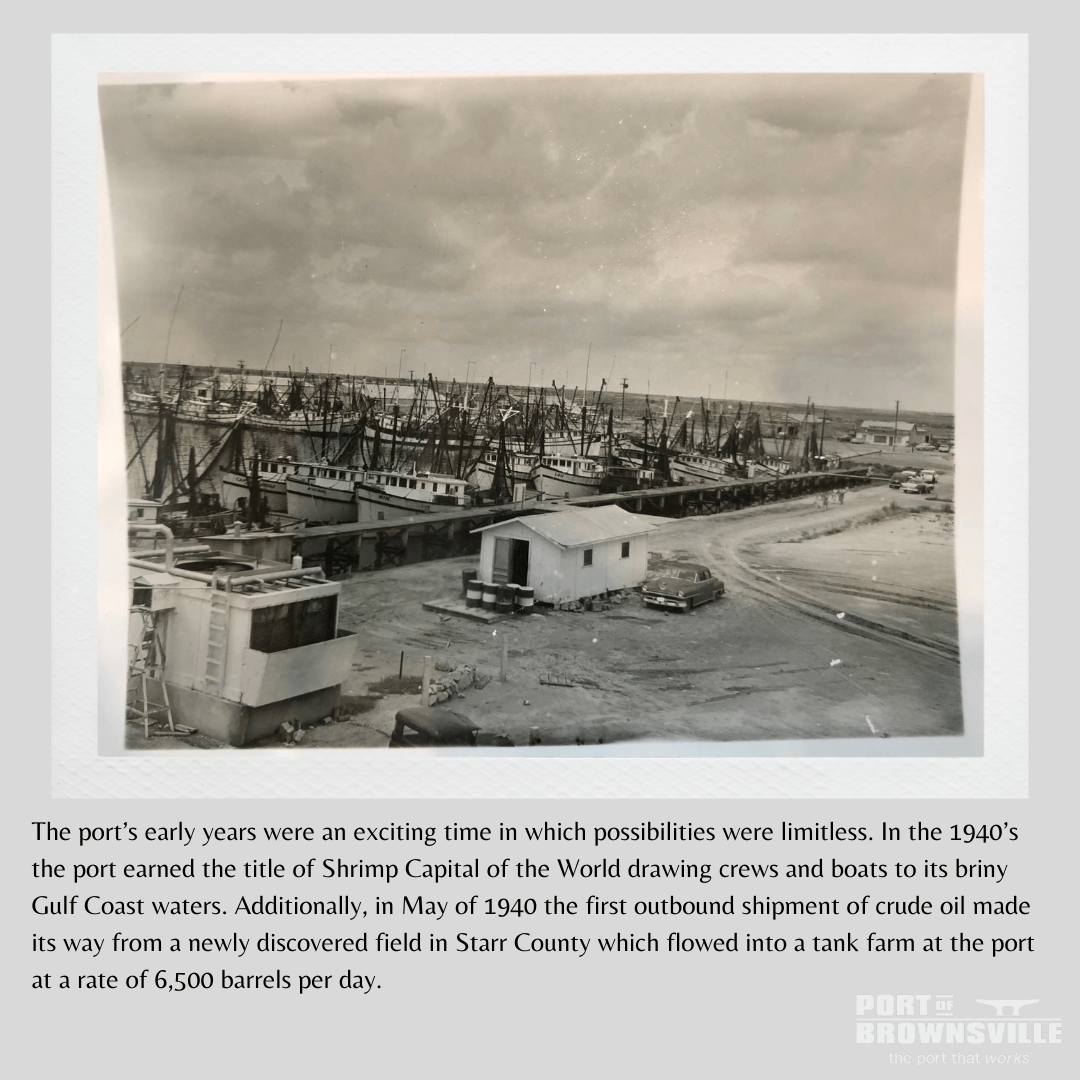

Since 1914, most of the world’s largest seaports had designed their channel depths to match that of the then new Panama Canal – 40 feet – so that Panamax ships (the maximum sized ships that could cross the Panama Canal) could safely call on their ports. That changed in 2016 when the expanded Panama Canal opened.

SOME KEY PLAYERS

One of the port’s key players is Keppel AmFELS, traditionally the port’s largest employer and a leading offshore shipyard on the Gulf of Mexico. Keppel AmFELS is capable of designing and constructing, refurbishing and repairing mobile drilling rigs and platforms from start to finish. For nearly 30 years, the international oil industry has relied on Keppel AmFELS to deliver rigs and platforms; Keppel is currently investing in new infrastructure and exploring opportunities in the Jones Act (the foundation for protectionist cabotage laws that govern shipping in the United States) vessel market.

Another new player is CSC Sugar which runs a packaging and distribution operation at the Port of Brownsville, receiving bulk sugar by rail from the West and Midwest for export.

TIMET, a Berkshire-Hathaway company, which supplies nearly one-fifth of the world’s titanium demands, and imports rutile ore through the port, which is finally shipped by rail to Nevada for processing, is another addition; it utilizes the port’s warehousing facilities and rail connectivity.

INFRASTRUCTURE DEVELOPMENT

Tyndal points out that the port itself is investing millions of dollars in infrastructure development. Liquid Cargo Dock 6 is currently under construction, with the rehabilitation of Liquid Cargo Dock 3 scheduled and funded. The port’s main administration complex is growing too, with the addition of a new records and permitting office as a component part of the expanded and completely remodeled main office campus, collectively valued at nearly $31 million.

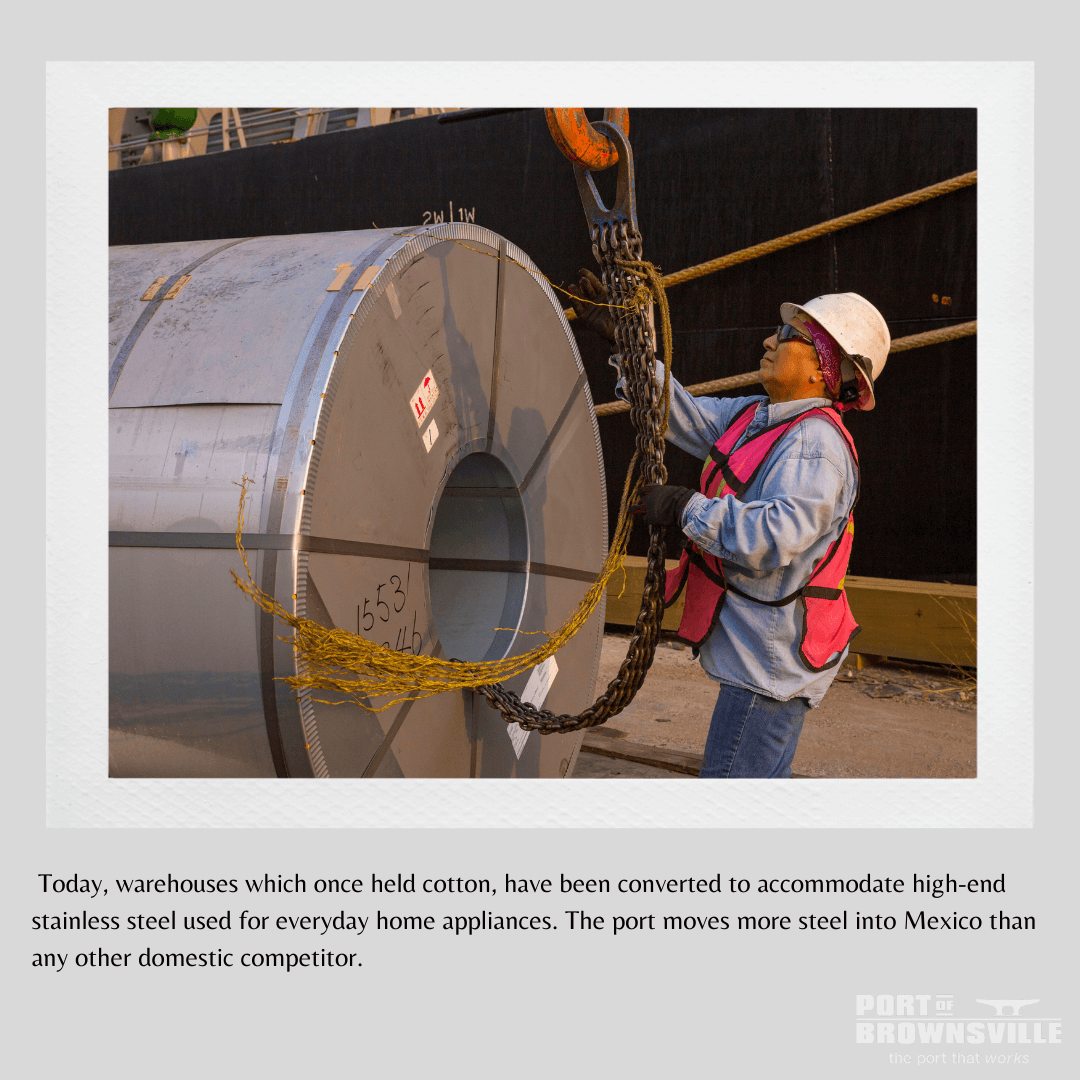

Next in line is the proposed multimodal dock, a comprehensive marine terminal served by expanded rail and roadway networks aimed at expediting cargo service to factories and consumers. Estimated to cost more than $32 million to construct, steel is expected to be the new dock’s primary commodity, freeing existing facilities for other cargo opportunities.

Tyndal said the port customers were interested to increase shipments to Mexico. “Our port offers good rail capacity for Mexico. We ship directly to steel companies in Mexico which offers great business opportunities,” he said; there are more than $43 billion worth of projects currently in the works.

Three liquefied natural gas (LNG) plants are nearing the end of the Federal Energy Regulatory Commission (FERC) permitting process and approaching their independent final investment decisions to build more than $38.75 billion worth of liquefaction terminals on about 2,300 acres of port-owned channel-side land.

The world’s first LEEDcertified steel mill, a $ 1.5 billion project, has narrowed its search for a home aside the Port of Brownsville’s 17-mile-long shipping channel and a competing site.

Multiple petroleum tank farms and marine terminals are currently expanding their operations and throughput capacities at the port, resulting in a total investment volume that exceeds $380 million.

The port, which shipped some 2.3 million tons of steel to Mexico, is bullish on the steel trade with Mexico. Mexico’s oil reforms have spurred traffic in petroleum products at previously unseen volumes, sharply increasing vessel, rail and highway movements to and from the port.

These activities have enabled the port’s Foreign Trade Zone to reach the number two spot in 2015 for the value of exported goods – $3.2 billion, marking the third time in as many years that FTZ No. 62 was within the top three in the U.S.

According to Martin Associates’ report, The Economic Impacts of the Port of Brownsville, 2015, cargo activity at the port’s marine terminals and rig repair operations support $3 billion in total Texas economic activity, sustaining over 44,000 jobs. The report concludes that $42.6 million of state and local tax revenue is generated by those activities, and another $121.7 million in state and local taxes are generated due to economic activity of related users of the cargo moving through the port’s marine terminals. Indeed, Tyndal said these factors made the port into the region’s leading economic driver.

NAFTA RHETORIC TONED DOWN

Presidential candidate Donald Trump election-campaign rhetoric to renegotiate the North American Free Trade Agreement (NAFTA) – the three partners in this agreement are Canada, Mexico and the United States – did, initially, cause trepidations in the three countries whose trade and business have intensified after NAFTA’s creation. The trepidations were further exacerbated after U.S. President Donald Trump, at the start of his Presidency, pulled out from the TransPacific Partnership (TPP).

However, experts discern a moderation in the tone of the U.S. administration which has been hinting that while it is necessary to revisit NAFTA after more than 20 years and fix some of the inherent inconsistencies in the three-nation trade, the NAFTA agreement’s main framework would remain unaffected.

Tyndal said that the initial NAFTA rhetoric had related to cost concerns but that rhetoric had, meanwhile, moderated, with the emphasis now being on NAFTA’s improvement and not its scrapping.

“The agreement is now over 20 years old and a lot has changed for all the three nations. It is prudent to take into account the changing realities and review the agreement. We are frequently in touch with our customers and I have yet to encounter anyone who has been critical of President Trump,” Tyndal explained.

With its special affiliation to Mexico, an important source of revenue, the Port of Brownsville is understandably interested in intensifying trade with Mexico and Central America.