BY GRACE LAVIGNE / American Metal Market

Article published June 6, 2017

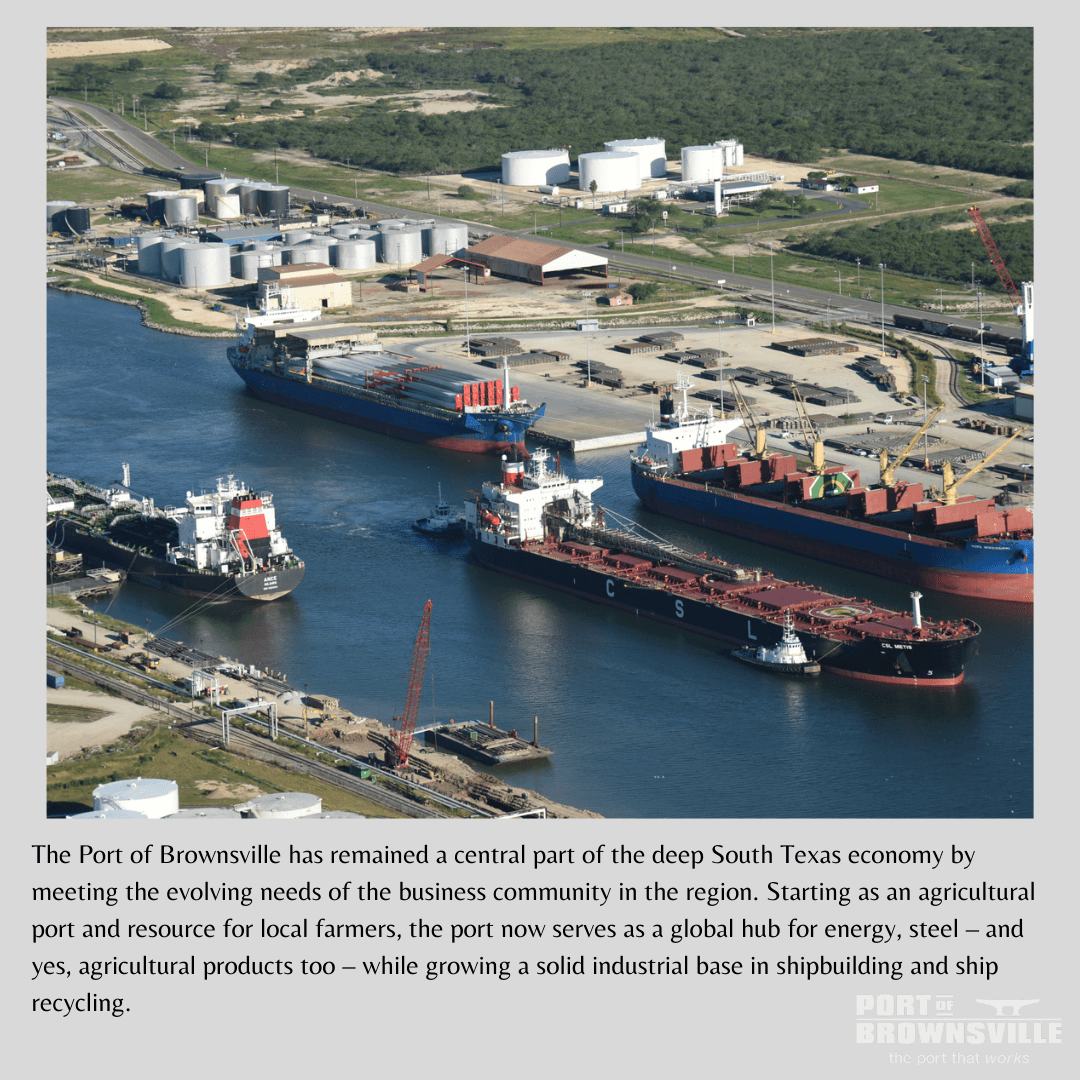

NEW YORK — The Texas port of Brownsville’s steel volumes are expected to remain stable despite anti-dumping duties and changing trade strategies, thanks to its unique position as a transshipment point for goods moving to Mexico, according to a port spokesman.

“The port has had a good run of growth in recent years,” Steve Tyndal, the port’s senior director of marketing and business development, told AMM.

In 2016, Brownsville handled 9.3 million tons of cargo including bulk, breakbulk and project cargoes, according to preliminary figures, down from a record 10.1 million tons in 2015, he said. That drop was related to one customer in particular, Tyndal noted, but last year’s figures are still up by more than one-third from 5.6 million tons in 2010.

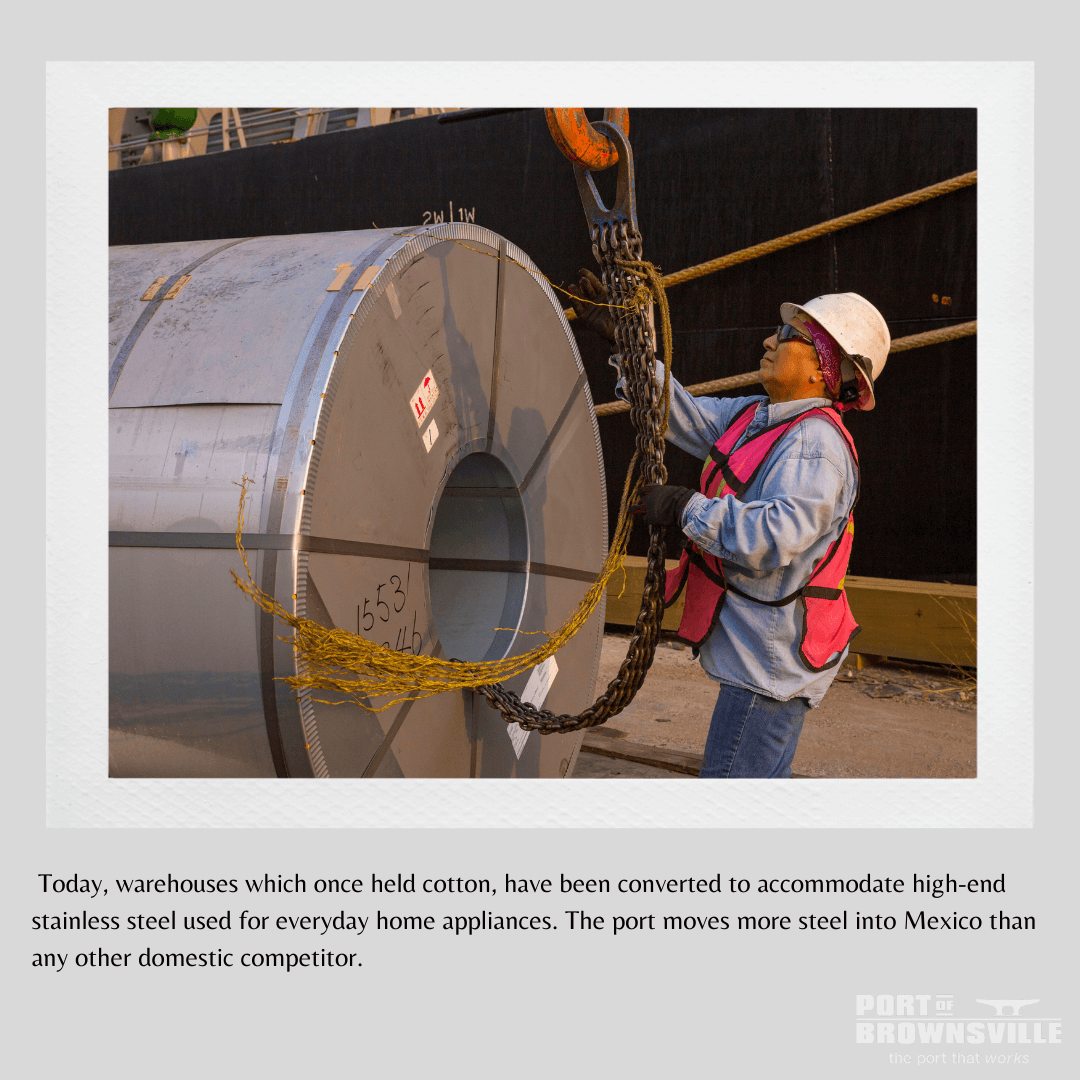

Nearly one-quarter of the port’s total volumes comprise steel products, which have remained fairly consistent over the same time period, according to Tyndal. Last year, the port moved more than 2.15 million tons of slabs, plus 260,000 tons of cold-rolled coil, 36,000 tons of hot-rolled coil and 117,000 tons of scrap, he said.

The balance of Brownsville’s business includes bulk goods—such as petroleum coke, cement, sugar, salt and grain—as well as project cargoes, including steel pipes and wind components, Tyndal added.

The port of Brownsville is in a unique position because more than roughly 95 percent of all of its incoming cargo is in transit to Mexico, according to Tyndal. Shippers moving cargo through the port can benefit from its foreign-trade zone, which exempts cargo from duty payments, he explained.

In 2015, the port’s foreign-trade zone imported $3.2-billion worth of commodities and exported $3.6 billion, according to Brownsville’s website. The top three commodities included petroleum products, steel and metals.

“Almost all of the steel that we move goes across the border” into Mexico, Tyndal said. The vast majority ends up in Monterrey, although some may head towards Mexico City as well, he said.

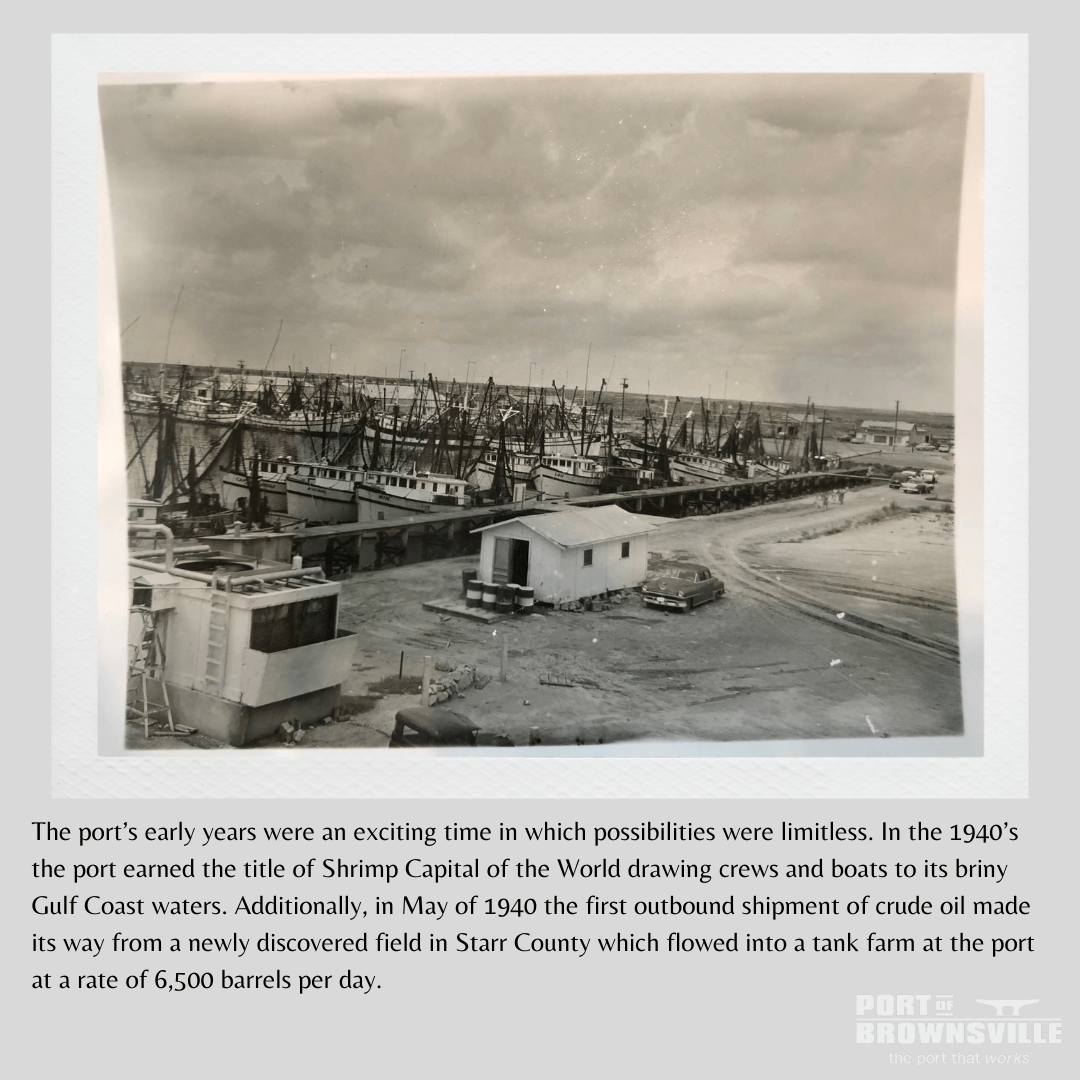

The port also is home to the nation’s largest ship-recycling business, and the recyclers in the area generate a significant amount of scrap, according to Tyndal. “Generally it is high-quality steel (scrap),” he said. “Some of that—in fact a fairly sizable amount—goes northbound. And based on the influence of the (U.S. dollar-Mexican peso exchange rate), some of it goes southbound.”

He classified the recent overall mood at the ship recycling companies as optimistic.

“Generally, they are feeling that there may be a slight uptick on the horizon for Mexico,” Tyndal said. “That’s not my opinion; that’s just what some leaders in the recycling business are telling me.”

Niche protects port from political headwinds

In terms of potential threats to the port of Brownsville’s business from the Section 232 investigation into steel imports, Tyndal commented: “I think it doesn’t apply to us, only because so much of our cargo is in a foreign-trade zone. I don’t want to say we’re exempt from it, but we’re not affected by it.”

However, the potential renegotiation of the North American Free Trade Agreement poses a more complicated situation, Tyndal said.

“We don’t know what we don’t know… (but still) the document is more than 20 years old,” he said. “It would probably be wise to review it to make it a better document. Hopefully the result will make trade with Canada and Mexico not just more profitable but more relevant.”

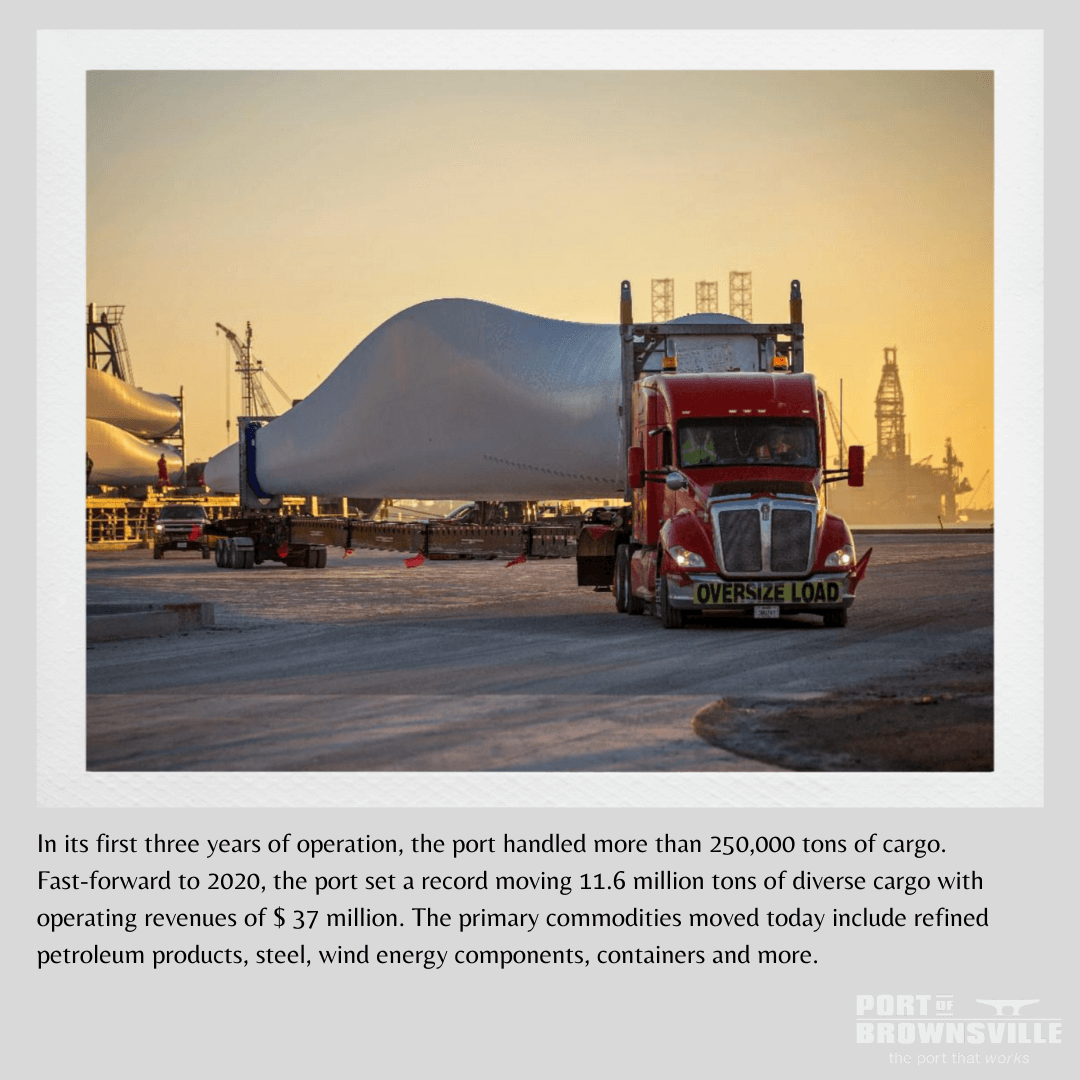

In addition, the potential increase in U.S. infrastructure spending in coming years could benefit the port’s channel-deepening project, which is expected to cost $253 million, according to Tyndal. The project received congressional authorization in December 2016, deeming it eligible for federal funding, he said.

“We would expect the federal government to live up to their obligation and support the project,” Tyndal said, citing the U.S. Army Corps of Engineers’ legal obligation to maintain U.S. waterways. “At the same time, we recognize the challenges of having a project like that funded by the federal government, so we’re not waiting. We’re doing exactly what the president said … by developing coalitions with public-private partnerships to dredge the channel now as opposed to waiting 10 to 15 years for funding to become available.”

As part of its funding strategy, the port will seek reimbursements from the federal government at a later date, he added.

“We had already made that decision before President (Donald) Trump announced that Tiger (Transportation Investment Generating Economic Recovery) grants would not be part of the (fiscal 2018 federal) budget,” Tyndal said.

“I wish there would be a consistent signal sent that shows that ports are being supported,” he continued, noting that such inconsistency is not unique to the current administration. “Without seaports, there is no international trade and commerce.”

There are currently $43-billion worth of projects in the works at the port of Brownsville, according to Tyndal. Some of those include the construction of liquefied natural gas plants and pipelines, plans for a new warehouse park, expansions at liquid tank farms and upgrades by some of the ship recyclers, he said.

“These and a number of other projects will change the landscape of the port for decades,” Tyndal said. “Every single one of these projects are steel-based; they either consume steel or make steel.”

The port itself also is planning $63 million in investments in a couple of projects, he said.

Last month, Big River Steel LLC announced it might build a new steel mill in Brownsville to supply steel sheet on a just-in-time basis to Mexico’s automotive sector.

Big River declined to comment on the time line for the project, but Tyndal said a decision is expected before the end of the year.